Expatriates face many challenges, make sure payroll isn’t one of them

Gross-up, offset and relax!

Complies with HMRC EP Appendix 5 and Appendix 6

In the increasingly global economy, the chances of having expatriates on your payroll is ever more likely.

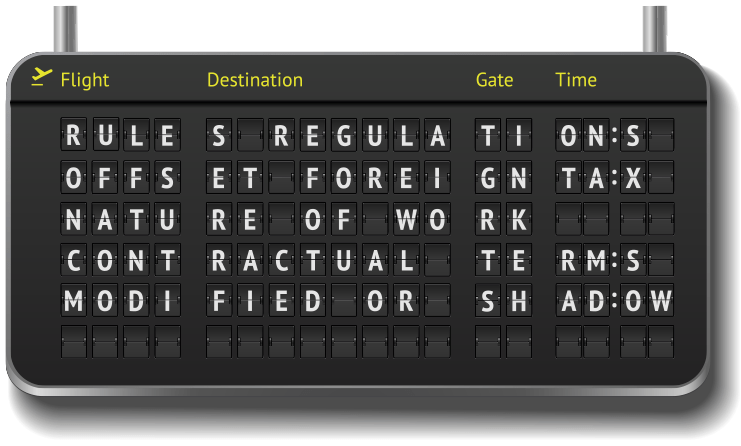

Processing expatriate payrolls, whether they be Modified, Shadow or just requiring the ability to off-set foreign tax, can be complex and challenging.

Rules and regulations can vary according to an individual's contractual terms, country of residence or the nature of work. Make a mistake and employers or employees can be exposed to inaccurate liability of tax and/or NI.

If your payroll software is unable to handle expatriates it can be a real headache; find out how Payroll Professional can ease the pain.

Payroll Professional’s Expatriate module is purpose built for payroll bureaux, financial institutions and international organisations in the UK who need a comprehensive solution for processing the complex requirements of inbound expats and compliance with HMRC EP Appendix 5 and EP Appendix 6 arrangements.

Key features include:

And with our ePayslips service allowing individuals to access their payslips anywhere in the world 24/7, you can rest assured that you and your expat staff will have the easiest payroll system in town.

Find out more about Payroll Professional’s solutions for

If you require more information

Enquire now